In 2018, General Electric, better known for its jet engines or power station, stunned the financial community. It announced that it had to take a $6.2 billion after-tax charge for GE’s long-term care insurance unit and will have to boost its reserves by $15 billion over seven years to cover claims on some 300,000 long-term care policies written more than a decade ago, when actuaries did not yet know how costly the claims would become.

Recently, Harry Markopolos, a fraud investigator (known for finding Bernie Madoff’s ponzi scheme) that (i) $15 billion will not be enough and (ii) that an accounting rule change for insurance liabilities and a significant lack of reserves to cover long-term care liabilities will push GE to take a $29 billion hit.

What is the problem with these long-term life insurance products?.

First let’s remind us how life insurance works. Like any other insurance products, life insurance is also based on the principle of pooling many risks in a group and accumulating the funds through the collection of premiums from the customers who are the members of the group. This pool of money is used to pay for the losses of those who die each year.

For pricing these products, the actuaries project all future cash flows on a probability weighted basis. The projection scenarios are to ensure that the collected premiums and their investment incomes are sufficient to cover the future benefits and expenses but also provide a good return on equity for the insurer.

For each scenario, the actuaries are using several sets of information and assumptions, to name a few:

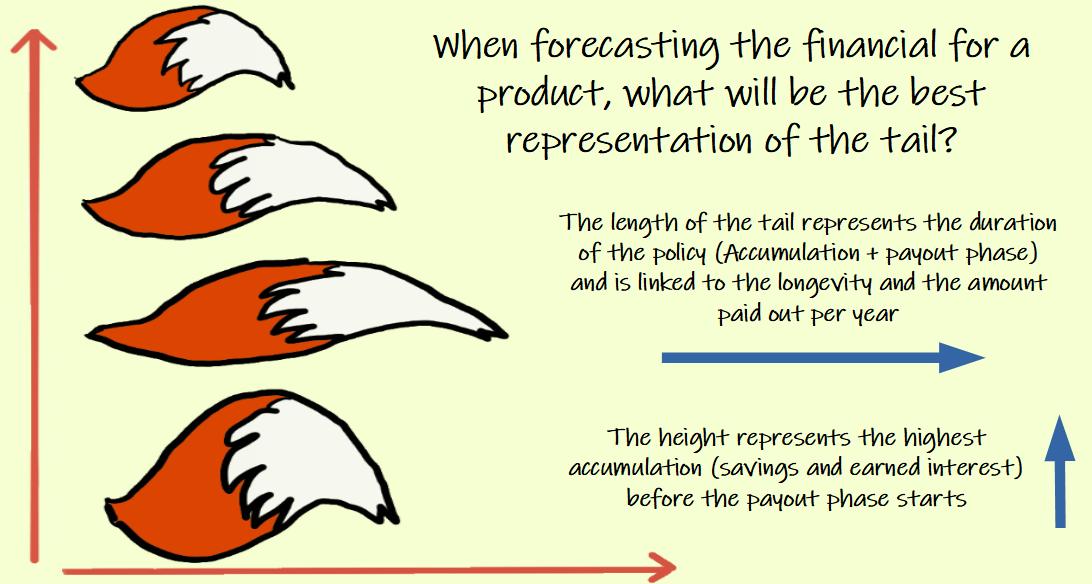

The same will apply for savings products or annuities, the actuaries will run different scenarios and use them to come up with the premium to be paid today for a payment in the future. Thus the analogy with a tail, each scenario looks like a tail as per our below illustration.

There are other factors which need to be considered but we will focus on (i) the longevity and (ii) the investment gains for the reserve.

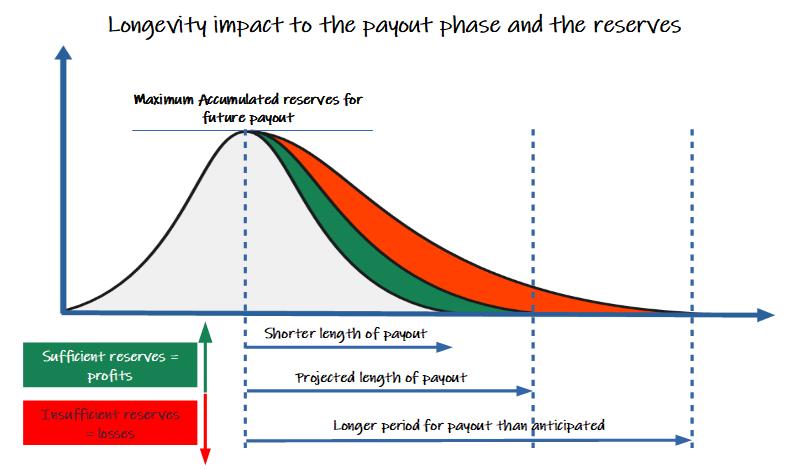

Illustration – longevity impact to life insurance reserves

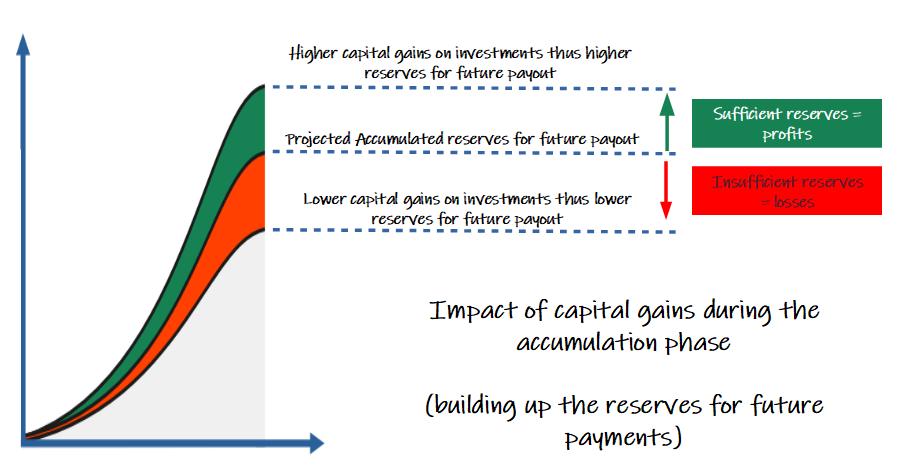

Illustration – Impact of capital gains to life insurance reserves

We are not mentioning that in the payout phase, the reserves are still invested. The investment income from the payout phase is also anticipated in the actuarial models mentioned earlier in this article. Therefore during the payout phase, the insurer could also have lower capital gains thus further impacting the overall results.

The issues with these life insurance products (but also the long tail products for general insurance) are that there are lots of unknowns when a new product is launched. A portfolio could look very profitable in an xls spreadsheet. In addition the complexity of the models in their files might give a false sense of safety for the life insurance actuaries. Who would have thought back in the 1990s or 1980s that negative interest rates could become a reality!

|

|

|||||

|---|---|---|---|---|---|

|

|

|

|

|

||

Our mission is to provide you with everything you need to be successful with your career in the #insurance ecosystem.

We believe that insurers have a similar role for the society than doctors, paramedics, firefighters who are always helping others. As part of their daily routine, the latter are keeping themselves up to date with the latest treatments for their patients. This often means getting trained on a regular basis.

With their key role for the society, the same is true for those working in the insurance ecosystem. Our purpose is to provide the adequate resources and tools to help the insurance professionals to be up to date with the latest technology developments but also products, while avoiding an information overload.

Complexity is at the core of the insurance industry. From coming up with the right price to cover a risk or to manage the float, insurers must reliably manage and keep an important amount of information. They also need to provide an answer to their clients’ problems and/or needs while being compliant with changing regulations.

Discover This Free Material >>